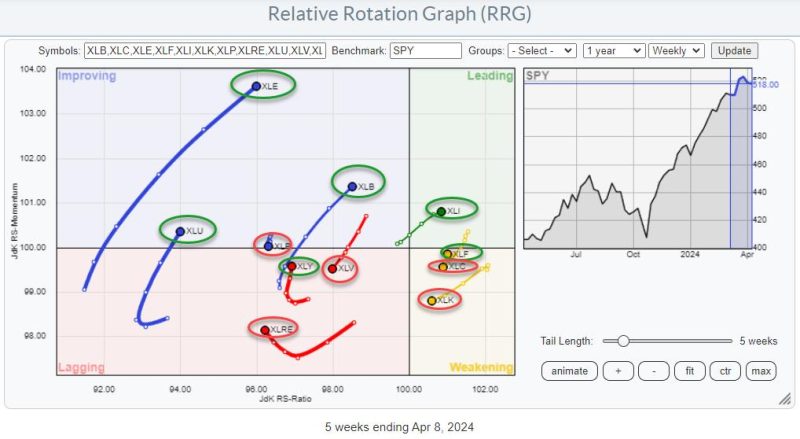

The semiconductor industry has long been dominated by mega-cap tech stocks such as Intel, AMD, and NVIDIA. However, recent data from the Relative Rotation Graph (RRG) analysis suggests that non-mega-cap technology stocks are starting to gain momentum and show signs of improvement in the market.

Traditionally, investors have gravitated towards the stability and size of mega-cap technology stocks, often overlooking smaller-cap companies in the sector. This trend is beginning to shift as RRG indicates that non-mega-cap tech stocks are moving into the improving quadrant on the graph. This shift could signify a potential opportunity for investors to diversify their portfolios and capitalize on the growth potential of these smaller companies.

One of the key factors driving the improvement in non-mega-cap tech stocks is their innovative products and solutions that cater to specific niches within the tech industry. These companies are often more agile and nimble in responding to market trends and customer needs, allowing them to capture market share and grow rapidly.

Another factor contributing to the improving performance of non-mega-cap tech stocks is the broader trend towards digital transformation across various industries. As businesses increasingly rely on technology to drive efficiency and competitiveness, there is a growing demand for specialized tech solutions, which smaller tech companies are well-positioned to provide.

Furthermore, non-mega-cap tech stocks tend to be less correlated with the overall market, offering investors diversification benefits and potentially reducing overall portfolio risk. With the rise of thematic investing and a focus on disruptive technologies such as AI, cybersecurity, and cloud computing, non-mega-cap tech stocks have the opportunity to outperform their larger counterparts in the coming years.

In conclusion, the RRG analysis indicating the improving performance of non-mega-cap technology stocks is a promising development for investors seeking growth opportunities in the tech sector. By considering smaller, innovative tech companies, investors can potentially enhance their portfolios and benefit from the unique growth prospects offered by these emerging players in the industry.