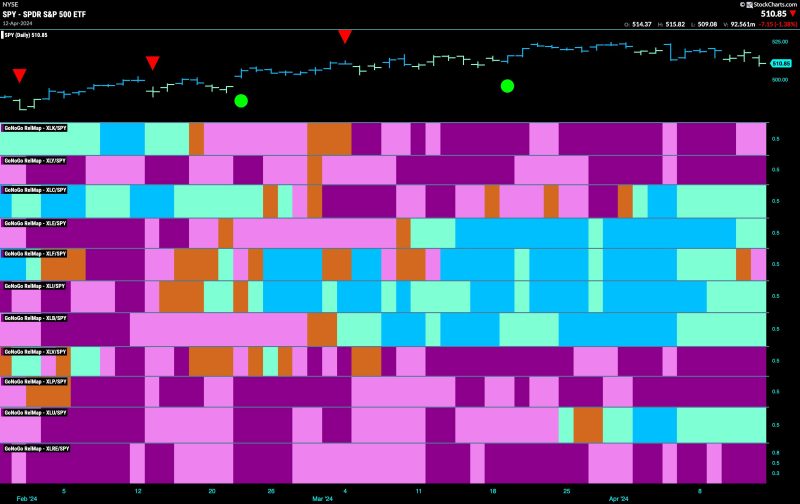

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead: Apr 15, 2024.

The equity markets continue to exhibit a mixed performance as the week progresses, with investors closely monitoring various signals and data points to determine the next direction for stock prices. Industrials are among the sectors that are attempting to lead the markets higher, while other segments face challenges in maintaining the upward momentum.

Market participants are grappling with uncertainties around economic growth, inflation, and central bank policies, which have added to the volatility in recent trading sessions. The ongoing geopolitical tensions in certain regions have also contributed to the cautious sentiment among investors, prompting some to adopt a wait-and-see approach before making significant moves in the markets.

The industrial sector has emerged as a standout performer, showing resilience in the face of broader market fluctuations. Companies within this segment have benefited from increased demand for their products and services, driven by improving economic conditions and infrastructure development projects. The focus on sustainability and innovation within the industrial sector has also garnered investor interest, as companies strive to align with evolving consumer preferences and regulatory standards.

On the other hand, certain sectors, such as technology and healthcare, have faced headwinds in recent trading sessions. Technology stocks have come under pressure due to concerns over regulatory scrutiny and potential shifts in consumer behavior, while healthcare companies grapple with uncertainty surrounding healthcare policies and drug pricing reforms. Despite these challenges, some investors view the pullback in these sectors as a buying opportunity, given their long-term growth potential.

The performance of individual stocks within the equity markets has varied widely, with certain companies outperforming their peers due to strong earnings reports or strategic initiatives. Investors are closely monitoring corporate guidance and financial results to gauge the health of individual companies and sectors, as these factors can significantly impact stock valuations in the short term.

As volatility persists in the equity markets, investors are advised to maintain a diversified portfolio and focus on long-term investment goals. Staying informed about market developments, economic indicators, and company-specific news can help investors make informed decisions amidst the ongoing fluctuations in stock prices.

In conclusion, the equity markets are navigating a challenging landscape characterized by mixed performance across sectors and heightened volatility. While certain segments, such as industrials, show strength in the current environment, other sectors face hurdles that are impacting their stock prices. By staying informed and maintaining a disciplined investment approach, investors can navigate the uncertainties in the markets and position themselves for long-term success.