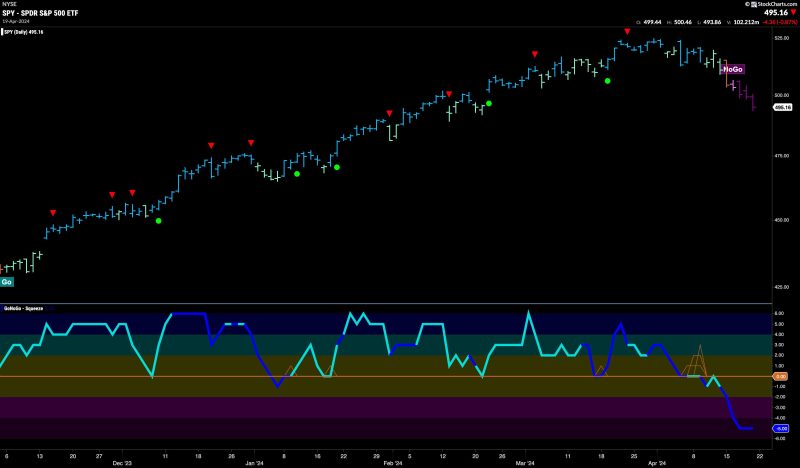

Equities Struggle in Strong NoGo as Materials Try to Curb the Damage

The global equity market is currently facing significant challenges amidst a strong NoGo environment. This term, coined to describe the current financial landscape by experts, reflects the uncertainties and complexities surrounding market developments. With equities struggling to find solid ground, investors are closely monitoring the situation for potential implications on their portfolios.

One sector that stands out amidst the turmoil is the materials industry. As other equities falter, materials companies are working diligently to curb the damage and maintain stability. The inherent resilience of the materials sector is attributed to its strategic positioning and unique features that set it apart from other industries.

One key factor bolstering the materials industry is its reliance on tangible assets. Unlike some sectors driven by intangible factors, materials companies deal with physical goods that have intrinsic value. This provides a certain level of insulation against volatility and market fluctuations, enhancing the sector’s ability to weather challenging times.

Furthermore, the materials industry plays a fundamental role in supporting various economic activities. From construction to manufacturing, materials are essential inputs that underpin the functioning of numerous sectors. This foundational aspect of the materials sector ensures a consistent demand for its products, even in the face of broader market uncertainties.

In addition to its tangible assets and foundational role in the economy, the materials sector benefits from innovation and adaptation. Companies within this industry are constantly developing new technologies and processes to improve efficiency, reduce costs, and enhance product quality. This commitment to innovation positions materials companies as key players in driving economic growth and sustainability.

Despite the overall difficulties in the equity market, the materials sector exhibits a sense of resilience and determination to overcome challenges. By focusing on tangible assets, maintaining a foundational role in the economy, and embracing innovation, materials companies continue to navigate turbulent times with cautious optimism. Investors and market observers are keenly watching how the materials industry’s strategic efforts unfold in the coming months and its impact on the broader financial landscape.