Certainly! Here is the article crafted based on the given reference link:

Relative Strength and Other Measures in Rules-Based Money Management

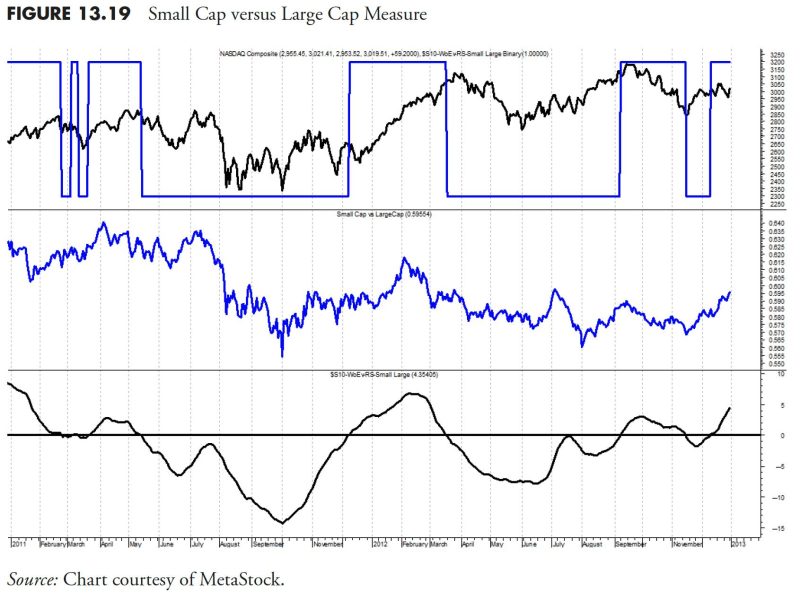

Relative Strength as a measurement in rules-based money management has gained substantial traction in recent times. The entity of Relative Strength plays a pivotal role in determining the performance of an asset or investment strategy relative to others in the market. It provides investors with a useful tool to gauge the potential of an investment based on its performance compared to other assets or strategies.

Relative Strength can be utilized in a variety of contexts within rules-based money management. One common application is the Relative Strength Ranking system, where investments are ranked based on their performance in comparison to other assets or funds. This ranking system allows investors to identify top-performing investments within a specific universe, aiding in the selection process for a diversified portfolio.

Moreover, Relative Strength can also be employed in trend-following strategies. By monitoring the relative performance of various assets or sectors, investors can identify trends and adjust their investment allocations accordingly. This approach allows investors to capitalize on market trends and allocate capital to areas showing strong relative performance.

In addition to Relative Strength, other measures play a crucial role in rules-based money management. Quantitative measures such as momentum, volatility, and correlation are essential factors that influence investment decisions. Momentum indicators help investors identify assets with strong positive or negative price trends, enabling them to make informed decisions based on market dynamics.

Volatility measures, on the other hand, help in assessing the risk associated with an investment. Assets with high volatility may not be suitable for all investors, and incorporating volatility measures into rules-based strategies can help manage risk and optimize returns. Furthermore, correlation measures assist in understanding the relationship between different assets or sectors, aiding in portfolio diversification and risk management.

When deploying rules-based money management strategies, it is essential to consider a holistic approach that integrates various measures, including Relative Strength and other factors. By combining multiple indicators and measures, investors can create robust and adaptive investment strategies that align with their financial goals and risk tolerance.

In conclusion, Relative Strength and other measures are integral components of rules-based money management strategies. These tools provide investors with valuable insights into market dynamics, helping them make informed investment decisions and optimize portfolio performance. By leveraging Relative Strength rankings, momentum indicators, volatility measures, and correlation analysis, investors can build diversified portfolios tailored to their investment objectives and risk preferences.

In the ever-evolving landscape of financial markets, incorporating Relative Strength and other measures into rules-based money management is crucial for achieving sustained success and maximizing long-term returns. By embracing these tools and strategies, investors can navigate market uncertainties with confidence and conviction.