The article talks about the current conditions in the market, suggesting that it may be nearing a top. It mentions various factors that indicate potential instability in the market and provides insights into what investors should consider during this time.

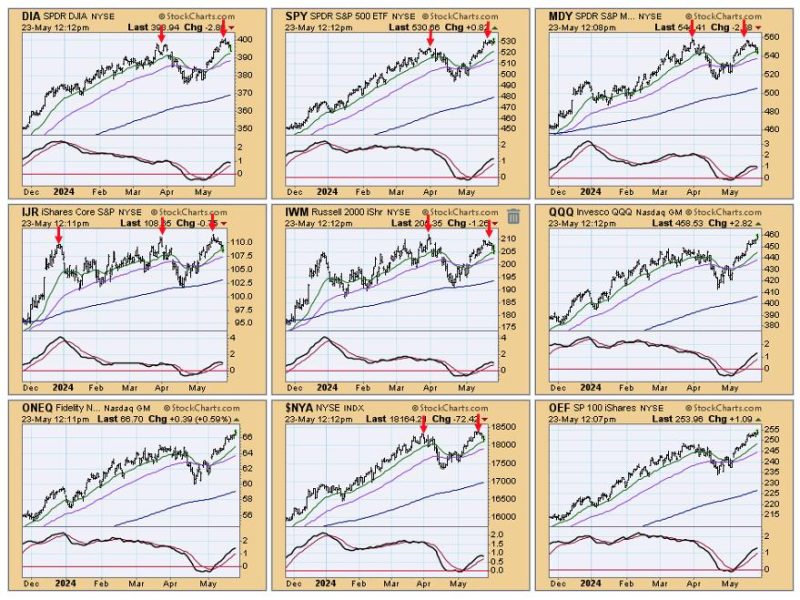

The article starts by highlighting the recent rise in stock market indexes, which have reached record highs. Despite this positive trend, the author notes that there are signals that the market might be becoming toppy, meaning that it could be reaching its peak before a potential decline.

One of the key indicators mentioned in the article is the high valuation of the stock market compared to historical averages. This is often a warning sign for investors as it indicates that stocks may be overpriced and due for a correction. The article advises readers to be cautious and consider rebalancing their portfolios to manage risk effectively.

Another factor discussed in the article is the potential impact of rising interest rates on the market. If interest rates increase, it could lead to higher borrowing costs for companies and consumers, which might slow down economic growth. Investors should be aware of this possibility and adjust their investment strategies accordingly.

Additionally, the article touches upon the volatility in the market caused by geopolitical tensions and trade disputes. Uncertainties surrounding these events can lead to market fluctuations and instability. It is essential for investors to stay informed and be prepared for potential market disruptions.

Overall, the article serves as a timely reminder for investors to stay vigilant and assess their risk exposure in light of the current market conditions. By being proactive and making well-informed decisions, investors can navigate through periods of market uncertainty with more confidence and resilience.