The recent appearance of the Hindenburg Omen, a technical indicator in the stock market, has garnered significant attention from investors and analysts alike. This signal, known for its forewarning of potential market downturns, has raised concerns about the future direction of stock prices. In this article, we will delve into the intricacies of the Hindenburg Omen and investigate its implications for investors.

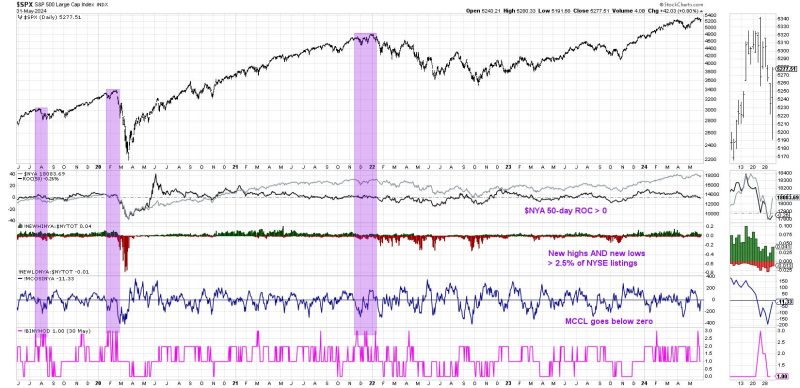

Understanding the Hindenburg Omen requires a grasp of market dynamics and technical analysis. Developed by mathematician James R. Miekka, the Hindenburg Omen refers to a set of criteria that need to be met simultaneously to trigger the signal. These criteria typically involve market breadth indicators such as the number of stocks hitting new highs and lows, advancing and declining issues, and the overall level of market volume. When these criteria align in a specific manner, it is seen as a warning sign of potential market turbulence ahead.

One of the key reasons why the Hindenburg Omen is considered significant is its track record of preceding major market downturns. While it is not infallible and false signals can occur, the omen has historically been associated with periods of heightened volatility and downside risk. This has led many investors to pay close attention when the signal flashes, as it could provide valuable insights into the market’s future trajectory.

It is essential to note that the Hindenburg Omen, like any other technical indicator, should not be used in isolation when making investment decisions. Market dynamics are influenced by a multitude of factors, including economic data, corporate earnings, geopolitical events, and investor sentiment. Therefore, while the omen’s appearance can serve as a cautionary signal, it is crucial to consider a holistic view of the market environment before taking any action.

For investors who are concerned about the implications of the Hindenburg Omen, there are several strategies that can be employed to mitigate risk. Diversification, a fundamental principle of investing, can help spread risk across different asset classes and reduce exposure to any single market downturn. Additionally, staying informed about market developments and maintaining a long-term perspective can aid in navigating volatile periods more effectively.

In conclusion, the Hindenburg Omen’s recent appearance has sparked discussions within the investment community about the potential implications for stock prices. While the omen is a noteworthy technical indicator with a history of preceding market declines, investors should approach it with caution and consider a comprehensive view of market dynamics before making any decisions. By staying informed, diversified, and disciplined, investors can better position themselves to weather potential market storms and achieve their long-term financial goals.