Rules-Based Money Management – Putting Trend Following to Work

Trend following is a popular trading strategy used by many investors and traders to capitalize on market trends. By following the direction of price movements, trend followers aim to ride the trend for as long as possible to maximize profits. In this article, we will explore how trend following can be implemented in a rules-based money management system to enhance trading performance.

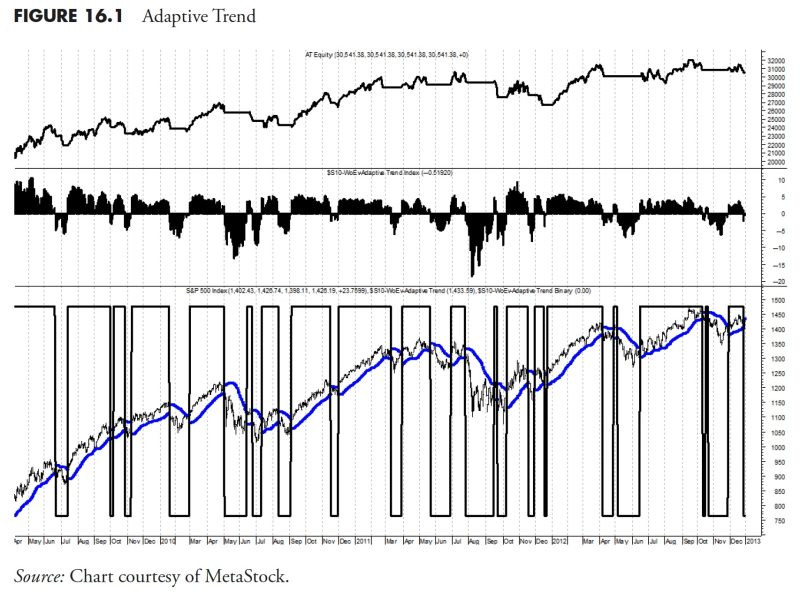

One of the key principles of trend following is to identify a clear trend in the market. This can be done using technical analysis tools such as moving averages, trendlines, and chart patterns. By analyzing price data, trend followers can determine the direction of the trend and establish entry and exit points for their trades.

In a rules-based money management system, traders outline specific rules for entering and exiting trades based on predefined criteria. By incorporating trend following into this system, traders can set rules that align with the strategy of riding trends. For example, a trader may set a rule to enter a trade only when the price is above a certain moving average, indicating an uptrend.

Another important aspect of trend following in a rules-based money management system is risk management. Traders must define the risk parameters for each trade, such as the maximum amount of capital that can be risked on a single trade or the maximum percentage of the account that can be exposed to risk at any given time. This helps to protect the trading account from excessive losses and ensures that risk is managed prudently.

Incorporating trend following into a rules-based money management system can help traders stay disciplined and consistent in their trading approach. By following predefined rules, traders can avoid emotional decision-making and maintain a structured trading process. This can lead to better trading outcomes and improved long-term performance.

Furthermore, implementing trend following in a rules-based money management system allows traders to capture large trends and maximize profit potential. By staying in a trade as long as the trend remains intact, traders can benefit from significant price movements and increase their profitability. This approach is particularly effective in trending markets where trends can last for extended periods.

In conclusion, trend following can be a valuable addition to a rules-based money management system. By incorporating specific rules for identifying trends, entering and exiting trades, and managing risk, traders can enhance their trading performance and achieve better outcomes. Trend following provides a systematic and disciplined approach to trading that can help traders navigate the complexities of the financial markets and capitalize on profitable opportunities.