In today’s fast-paced financial markets, pre-earnings moves play a vital role in investor decision-making. Traders and analysts are constantly on the lookout for clues and patterns that can help them predict and capitalize on these moves. By studying historical data and trends, market participants gain valuable insights that can inform their strategies and timing. Let’s delve deeper into how historical analysis can provide key clues for understanding and navigating pre-earnings moves.

The concept of pre-earnings moves refers to the price action of a stock before a company reports its quarterly or annual earnings. These moves can be influenced by a variety of factors, including market sentiment, analyst expectations, and company-specific news. Traders often seek to anticipate these moves in order to position themselves for potential profits or to protect against downside risk.

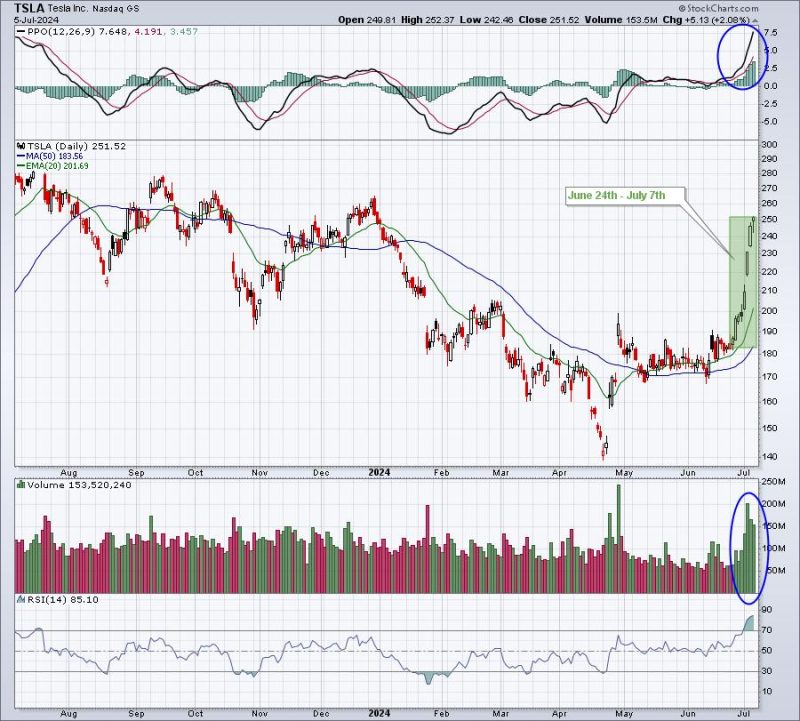

One approach to analyzing pre-earnings moves is to study historical price behavior leading up to earnings announcements. By examining past patterns, traders can identify recurring trends and tendencies that may provide insights into future movements. For example, a stock that consistently experiences a sharp rally in the days leading up to earnings may suggest bullish sentiment among investors.

Additionally, historical data can reveal correlations between pre-earnings moves and other variables, such as trading volume, option activity, or technical indicators. By analyzing these relationships, traders can develop more informed trading strategies and risk management plans. For instance, an increase in trading volume preceding an earnings report may indicate heightened market anticipation and volatility.

Moreover, historical analysis can help traders identify outlier events or anomalies that may impact pre-earnings moves. By studying past instances of unusual price behavior, traders can better prepare for unexpected developments and adjust their trading approach accordingly. This proactive stance can enhance risk mitigation and decision-making during volatile market conditions.

Furthermore, historical analysis can be used to assess the efficacy of different trading strategies and methodologies in the context of pre-earnings moves. By backtesting various approaches against historical data, traders can evaluate performance metrics such as profitability, drawdowns, and risk-adjusted returns. This empirical approach allows traders to refine their strategies and optimize their decision-making process.

In conclusion, historical analysis provides valuable insights and clues for understanding and navigating pre-earnings moves in financial markets. By studying past price behavior, correlations, anomalies, and testing trading strategies, traders can enhance their decision-making process and improve their risk management capabilities. Utilizing historical data as a guide, market participants can better position themselves to capitalize on opportunities and mitigate risks associated with pre-earnings moves.