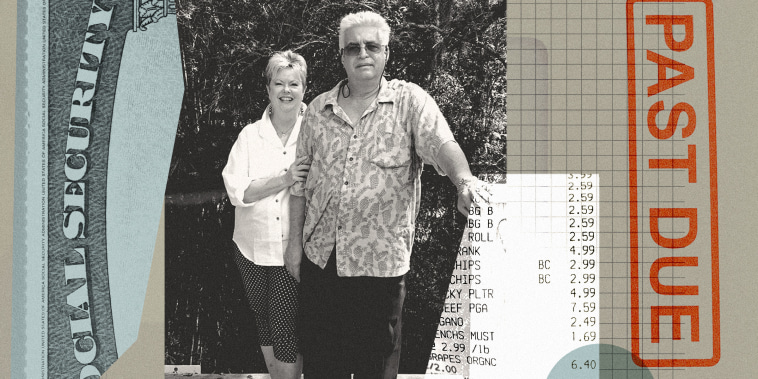

The article discusses the challenging situation faced by a Florida retiree who finds herself living off $2,400 a month after her savings were drained. This predicament serves as a stark reminder of the importance of financial planning and saving for retirement.

First and foremost, the case highlights the critical need for individuals to have a solid financial plan in place for their retirement years. Proper financial planning involves setting realistic savings goals, investing wisely, and adjusting one’s lifestyle to ensure that there are enough funds to sustain a comfortable retirement. Without a well-thought-out financial strategy, retirees may find themselves struggling to make ends meet as they age.

In this particular instance, the retiree’s savings were drained due to various factors, including medical bills and unexpected expenses. This emphasizes the importance of having a robust emergency fund to cover unforeseen costs that may arise during retirement. Ideally, retirees should have a financial buffer in place to shield them from financial setbacks and unexpected bills that could deplete their savings.

Furthermore, the retiree’s situation underscores the significance of living within one’s means and making prudent financial decisions. While it can be tempting to overspend or indulge in luxuries during retirement, it is essential to practice financial discipline and prioritize long-term financial security over short-term gratification. By living frugally and making wise financial choices, retirees can stretch their savings and ensure a more stable financial future.

Additionally, the case serves as a cautionary tale about the risks of relying solely on savings to fund retirement. With the rising cost of living and unpredictable economic conditions, retirees may face challenges in sustaining their desired lifestyle solely through their savings. Diversifying income sources, such as pensions, investments, or part-time work, can provide retirees with additional financial stability and reduce the likelihood of running out of funds during retirement.

In conclusion, the story of the Florida retiree living off $2,400 a month after her savings were drained serves as a poignant reminder of the importance of prudent financial planning, emergency preparedness, and living within one’s means during retirement. By taking proactive steps to secure their financial future, retirees can enjoy their golden years with peace of mind and financial security.