The Federal Reserve (Fed) has often been perceived as the guardian of the U.S. economy, equipped with the tools and knowledge needed to steer the financial ship through choppy waters. However, recent developments suggest that the Fed may have inadvertently created a situation that could potentially turn into a nightmare scenario for both the economy and the American people.

One of the primary roles of the Fed is to manage monetary policy by setting interest rates and controlling the money supply. In response to the economic challenges posed by the global pandemic, the Fed embarked on an aggressive program of quantitative easing, purchasing trillions of dollars’ worth of government bonds and mortgage-backed securities to inject liquidity into the financial system.

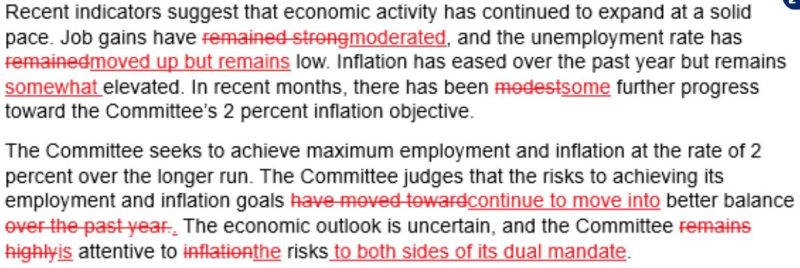

While these measures were initially intended to support the economy and prevent a collapse of the financial markets, they have also had unintended consequences. One of the most concerning outcomes of the Fed’s actions is the inflationary pressure that has been building in the economy.

Inflation occurs when the general price level of goods and services rises, eroding the purchasing power of consumers and reducing the value of money. The massive influx of liquidity into the system by the Fed has fueled asset price inflation, causing the prices of stocks, real estate, and other assets to soar to record highs.

This asset price inflation has exacerbated wealth inequality, as the wealthiest individuals who own a significant portion of these assets have seen their net worth skyrocket, while ordinary Americans struggle to make ends meet. The rising cost of living, coupled with stagnant wages, has placed a heavy burden on working-class families, many of whom are finding it increasingly difficult to afford basic necessities.

Moreover, the inflationary pressure created by the Fed’s actions has the potential to spiral out of control if left unchecked. As prices continue to rise, the Fed may be forced to raise interest rates to cool down the economy, leading to a slowdown in economic growth and potentially triggering a recession.

Furthermore, the Fed’s aggressive quantitative easing program has also distorted financial markets and incentivized risky behavior among investors. Low-interest rates have fueled a speculative frenzy in the stock market, with many companies trading at valuations that far exceed their underlying fundamentals.

This speculative bubble could burst at any moment, leading to a sharp correction in stock prices and potentially triggering a financial crisis similar to the one experienced in 2008. The Fed would then be faced with the daunting task of trying to contain the fallout and prevent a full-blown economic collapse.

In conclusion, while the Fed’s intentions may have been noble in trying to support the economy during a period of unprecedented challenges, its actions have inadvertently created a situation that could potentially turn into a nightmare scenario for both the economy and the American people. It is crucial for the Fed to carefully navigate the path forward, taking into consideration the long-term implications of its monetary policy decisions and striving to strike a balance between supporting economic growth and safeguarding against inflation and financial instability.