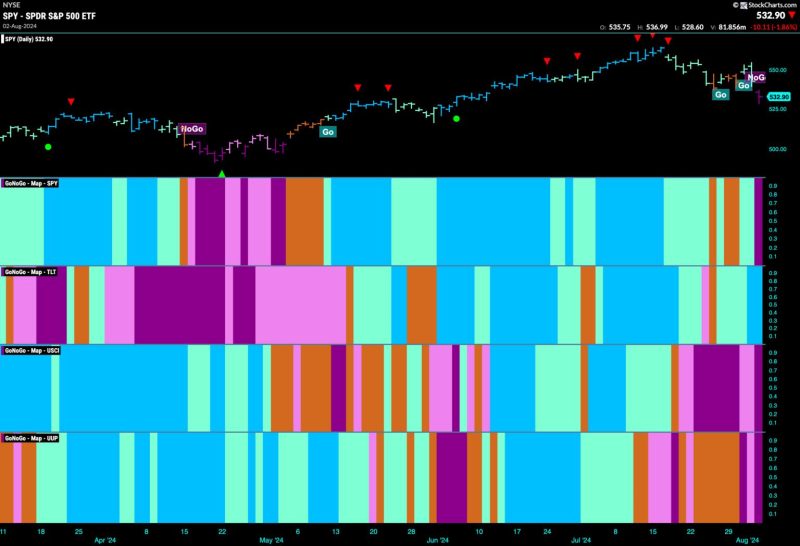

Stocks Get Defensive as Market Index Enters No-Go Zone

Investors typically associate the term defensive stocks with sectors that are less sensitive to economic cycles. These sectors tend to perform well during downturns, providing stability and reliable returns. When market conditions worsen and uncertainty looms, investors often flock to defensive stocks as a safe haven to weather the storm.

The recent entry of the market index into the no-go zone has prompted investors to reassess their portfolios and consider defensive strategies. The no-go zone, characterized by heightened volatility and increased risk, signals a potentially challenging period ahead for the stock market. In such uncertain times, it is crucial for investors to adopt a defensive stance to protect their investments.

Defensive stocks typically belong to industries that offer essential goods and services, such as utilities, consumer staples, and healthcare. These companies tend to have stable cash flows, strong balance sheets, and a history of paying dividends. During economic downturns, consumer spending on essentials like food, utilities, and healthcare remains relatively stable, providing a buffer against market volatility.

Investors flock to defensive stocks not only for their stability but also for their ability to generate steady income in the form of dividends. With interest rates at historic lows, dividends from defensive stocks can offer an attractive alternative to traditional fixed-income investments. This income can provide investors with a reliable source of cash flow, regardless of market conditions.

In addition to their defensive nature, these stocks often demonstrate lower volatility compared to the broader market. This reduced price fluctuation can help investors navigate turbulent market conditions with greater ease and peace of mind. By focusing on defensive stocks, investors can reduce their exposure to market risk and mitigate potential losses during periods of heightened uncertainty.

However, it is important to note that not all defensive stocks are created equal. Investors should conduct thorough research and analysis to identify the most suitable defensive stocks for their portfolios. Factors such as industry dynamics, company fundamentals, and valuation metrics should all be carefully considered before making investment decisions.

As the market index enters the no-go zone, investors would be wise to prioritize defensive strategies to safeguard their portfolios against potential downturns. By allocating a portion of their holdings to defensive stocks, investors can enhance portfolio resilience and weather market volatility more effectively. In times of uncertainty, a defensive stance can provide peace of mind and help investors navigate challenging market conditions with confidence.