In analyzing market movements, it is crucial to understand various perspectives to gain a comprehensive view. Particularly, when observing Nifty, looking at multiple angles can provide valuable insights for investors and traders alike.

One perspective to consider is the historical performance of Nifty. By reviewing past trends and patterns, one can better anticipate potential future movements. This historical analysis allows for the identification of key support and resistance levels, trends, and possible trading opportunities. It also helps in understanding how external factors such as economic conditions, political events, and global trends impact the index.

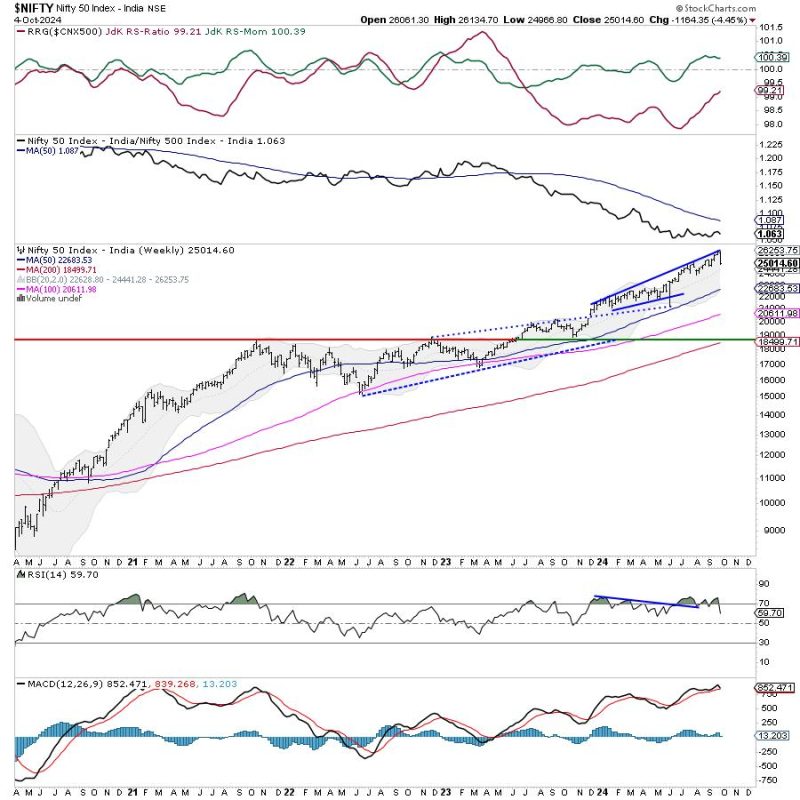

Another important angle to observe is the technical analysis of Nifty. Technical indicators like moving averages, relative strength index (RSI), and MACD can help in identifying overbought or oversold conditions, trend reversals, and potential entry and exit points. Additionally, chart patterns such as head and shoulders, flags, and triangles can offer insights into possible price movements.

Furthermore, monitoring market sentiment is essential when analyzing Nifty. Sentiment indicators like the put-call ratio, VIX (volatility index), and investor surveys can provide information about market participants’ confidence levels and expectations. Understanding sentiment can help in gauging potential market direction and identifying contrarian trading opportunities.

Considering macroeconomic factors is another significant aspect when observing Nifty. Changes in interest rates, GDP growth, inflation, and global economic conditions can play a pivotal role in influencing the index’s movements. Being aware of such fundamental indicators can help in making informed decisions about market entry and exit points.

Moreover, geopolitical events and news developments can have a substantial impact on Nifty. Factors like trade tensions, geopolitical conflicts, and policy changes can create volatility in the market. Staying informed about these external factors can help in anticipating potential market reactions and adjusting trading strategies accordingly.

By combining these different perspectives – historical performance, technical analysis, market sentiment, macroeconomic factors, and geopolitical events – investors and traders can develop a well-rounded understanding of Nifty’s movements. This comprehensive approach enables them to make informed decisions, manage risks effectively, and capitalize on opportunities in the market.