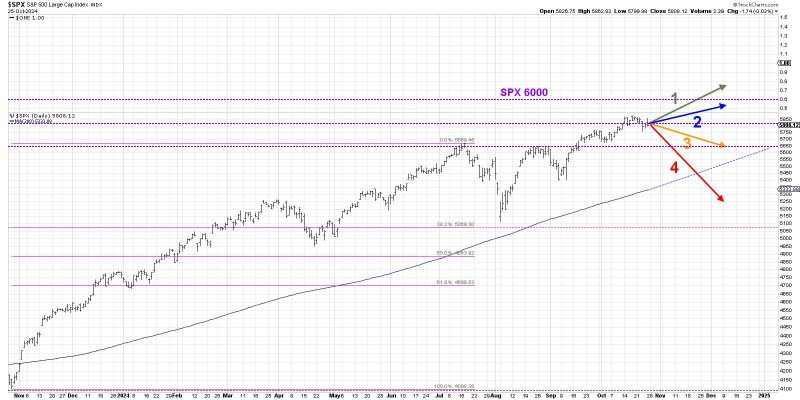

In a recent analysis by financial experts, it has been suggested that the S&P 500 might not break the significant 6000 level anytime soon. This prediction is based on various factors that are currently influencing the market and the overall economic landscape.

One crucial factor that is impeding the S&P 500 from reaching the 6000 level is the uncertainty surrounding global economic conditions. The ongoing trade tensions between major economies, such as the US and China, have created a sense of instability in the global market. This uncertainty has led to fluctuations in stock prices and has made investors cautious about committing to large positions in the market.

Moreover, the current interest rate environment is also a significant consideration when assessing the likelihood of the S&P 500 breaking the 6000 level. The Federal Reserve’s approach to monetary policy plays a crucial role in influencing stock prices. With interest rates being kept at historically low levels, there is a sense of complacency among investors, which could prevent the market from making a significant breakthrough to the 6000 level.

Additionally, the overall valuation of the market is another factor to consider when evaluating the potential for the S&P 500 to surpass the 6000 mark. Some analysts argue that the market might be overvalued, considering the current economic conditions and corporate earnings outlook. This overvaluation could act as a roadblock for the S&P 500 to achieve the 6000 level, as investors may choose to wait for more favorable valuations before committing to the market.

Furthermore, the recent surge in inflation rates has also contributed to the uncertainty surrounding the S&P 500’s ability to break the 6000 level. Rising inflation can erode the purchasing power of consumers, leading to reduced spending and overall economic slowdown. This could have a negative impact on corporate earnings and, subsequently, on stock prices, preventing the market from reaching new highs.

In conclusion, while the S&P 500 has shown remarkable resilience and growth in recent years, several factors suggest that breaking the 6000 level might not happen imminently. The ongoing global economic uncertainties, interest rate environment, market valuation, and inflation rates all play crucial roles in determining the market’s trajectory. Investors should continue to monitor these factors closely and adjust their strategies accordingly to navigate the current market conditions effectively.