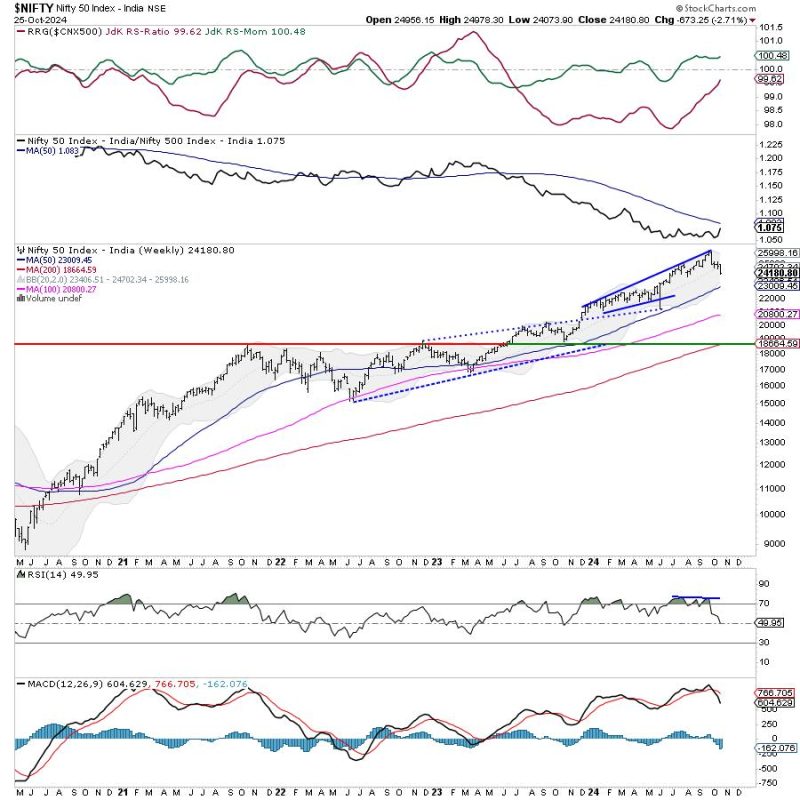

In the realm of financial markets, the recent movements in the Nifty index have been closely watched and analyzed by investors and traders alike. As the Nifty violated key support levels, it set in motion a chain of events that have caused resistance levels to shift lower.

One of the most significant developments in this regard has been the breach of crucial support levels by the Nifty index in recent trading sessions. The violation of these support levels has signaled a potential change in market dynamics and sentiment, prompting many market participants to reassess their strategies and positions.

The downward movement in the Nifty index has been met with increasing resistance levels, which have further pushed the index lower. This dynamic interplay between support and resistance levels has created a challenging environment for traders, requiring them to adapt quickly to the changing market conditions.

The implications of the Nifty violating key support levels are significant, as they can potentially trigger a broader market correction or signal a trend reversal. Traders and investors are closely monitoring the Nifty’s movements to gauge the market’s direction and potential opportunities for profit.

Furthermore, the shifting resistance levels are adding an element of uncertainty to the market, as traders are grappling with the prospect of further downside pressure. The evolving resistance levels are acting as a barrier to the Nifty’s upward movement, making it increasingly difficult for the index to recover lost ground.

In conclusion, the recent developments in the Nifty index have underscored the importance of monitoring support and resistance levels in navigating the complexities of the financial markets. As the Nifty continues to grapple with key support violations and shifting resistance levels, traders and investors need to stay vigilant and nimble to capitalize on emerging opportunities while managing downside risks effectively.