In the past week, the Nifty witnessed a mixed trend as it struggled to maintain stability amidst ongoing selling pressure at higher levels. Analysts and market experts foresee a similar scenario in the coming week, with expectations of a stable start but caution regarding the sustained selling pressure that might persist. Let’s delve into the factors and technical indicators that are likely to influence the Nifty’s movements in the upcoming week.

**Global Market Trends and Economic Indicators**

Global market conditions are expected to play a significant role in shaping the Nifty’s movement ahead. Rising inflation concerns, global economic data releases, and developments in key financial markets could impact investor sentiment. Traders will keep a close eye on cues coming from international markets, particularly from the US and China, to gauge the overall risk appetite among investors.

**Domestic Catalysts**

On the domestic front, market participants will closely monitor the progress of monsoon, which is vital for the agriculture sector and overall economic growth. The upcoming Union Budget session and corporate earnings announcements will also be crucial events that could sway market sentiment.

**Technical Analysis and Key Levels**

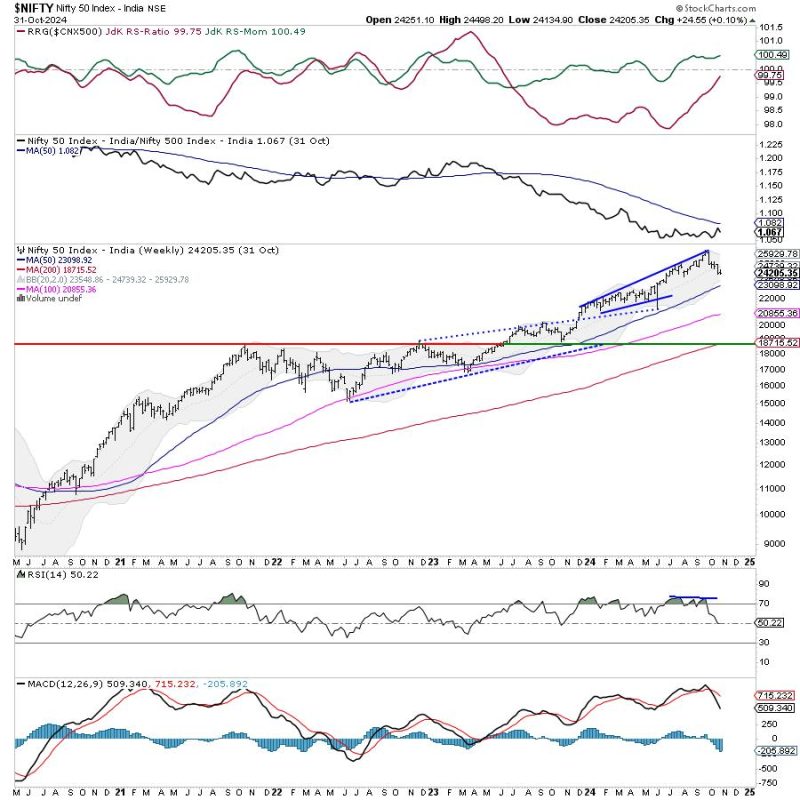

Technical indicators suggest a cautious outlook for the Nifty in the coming week. The index is likely to face resistance at higher levels, making it vulnerable to profit-booking and pullbacks. Traders will closely watch the key support and resistance levels to identify potential entry and exit points. A breach above crucial resistance levels could signal a bullish trend, while consistent selling pressure might drag the Nifty lower.

**Sectoral Performance and Stock-specific Action**

Sectoral performance will continue to influence the broader market movement, with sectors like IT, pharma, and FMCG likely to attract investor interest. Additionally, stock-specific developments, including corporate earnings, news flows, and macroeconomic data, could drive individual stock prices and sectoral indices.

**Risk Factors and Market Sentiment**

Uncertainty surrounding the global macroeconomic environment, geopolitical tensions, and the evolving COVID-19 situation remain key risk factors that could impact market sentiment. Investors are advised to stay vigilant, exercise caution, and adopt a prudent risk management strategy to navigate the dynamic market conditions.

**Conclusion**

As the Nifty gears up for the upcoming week, market participants are bracing themselves for a volatile trading environment characterized by selling pressure at higher levels. By closely monitoring global cues, economic indicators, technical levels, and sectoral developments, investors can position themselves strategically to make informed trading decisions. Adhering to a disciplined approach and staying informed about evolving market trends will be essential for navigating the uncertainties ahead.

*Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Readers are advised to conduct their research and consult with a financial advisor before making any investment decisions.*