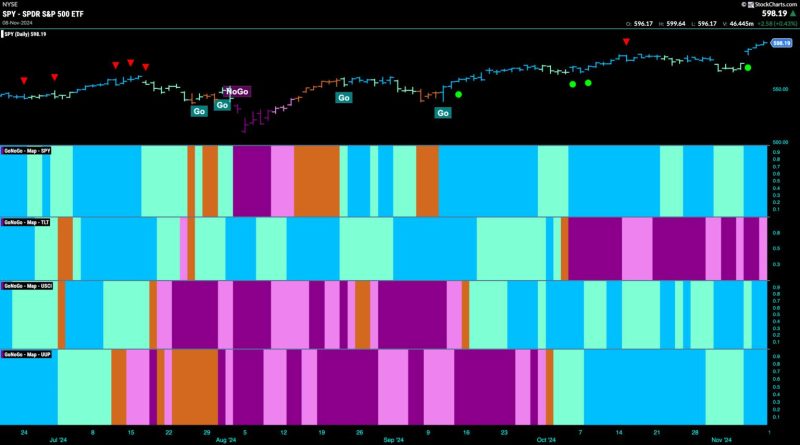

Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher

The Equity-Go trend is experiencing a notable surge in strength recently, with financials serving as the primary driving force behind the uptick in prices. Companies across various sectors are witnessing significant gains as the equity market continues to rally. This resurgence in strength can be attributed to a combination of factors that are propelling financials higher and attracting investors to the equity-dominant market.

Among the key drivers of this trend is the robust performance of financial institutions, notably banks and investment firms. These entities are benefiting from a favorable economic environment marked by rising interest rates and a strong demand for financial services. As interest rates climb, financial institutions stand to profit from higher net interest margins, which are bolstering their bottom lines and attracting investors seeking exposure to this sector.

Additionally, the broader equity market is also seeing positive momentum, driven by a combination of strong corporate earnings, robust consumer spending, and overall economic growth. Companies across various sectors, including technology, healthcare, and consumer discretionary, are contributing to the rally as they continue to deliver impressive financial results. This broad-based strength is further fueling investor optimism and attracting capital flows into equities.

The Equity-Go trend is also benefiting from increased investor confidence and a shift towards riskier assets. As uncertainties surrounding the global economic outlook begin to dissipate, investors are becoming more comfortable taking on additional risk and diversifying their portfolios with equities. This growing risk appetite is evident in the surge in stock prices and the overall bullish sentiment prevailing in the market.

Moreover, the Equity-Go trend is gaining traction amid ongoing monetary policy support from central banks worldwide. Lower interest rates and accommodative monetary policies have fueled economic growth and provided a supportive backdrop for equity markets. As central banks maintain their dovish stance and continue to inject liquidity into the financial system, investors are likely to remain drawn to equities as an attractive investment option.

Overall, the Equity-Go trend is experiencing a surge in strength, driven by the robust performance of financials and the broader equity market. With financial institutions leading the charge and investors showing increased confidence in equities, the trend is likely to continue its upward trajectory in the near term. As economic conditions remain favorable and central banks provide support, the Equity-Go trend is poised to see further gains, offering lucrative opportunities for investors seeking exposure to the equity market.