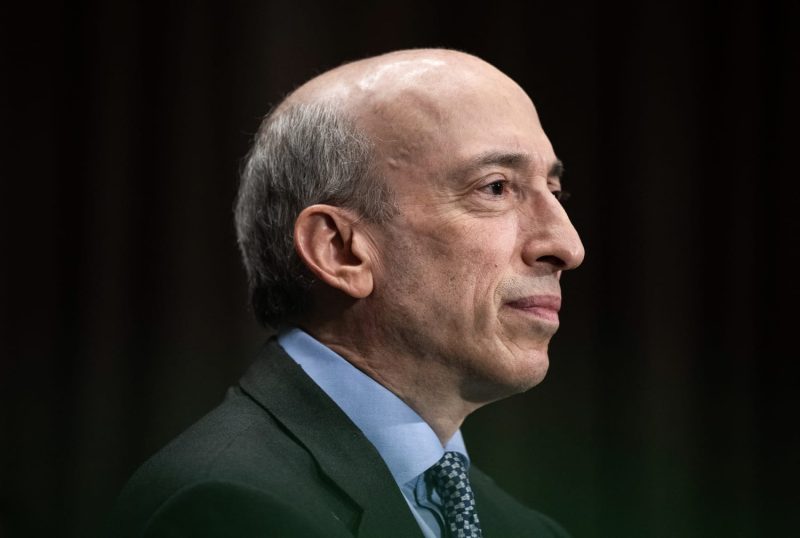

In a surprising turn of events, Securities and Exchange Commission (SEC) Chair Gary Gensler announced his decision to step down from his position effective January 20th, ushering in a new chapter for the regulatory body. Gensler’s departure comes amidst a backdrop of significant regulatory challenges and heightened scrutiny of the financial markets. As the head of the SEC, Gensler has been a prominent figure in spearheading key initiatives aimed at enhancing transparency, investor protection, and market efficiency.

During his tenure, Gensler pursued an ambitious agenda focused on modernizing the regulatory framework to adapt to the rapid pace of technological change in the financial services industry. One of his key priorities has been to address the proliferation of digital assets and the growing influence of decentralized finance (DeFi) platforms. Gensler has been a vocal advocate for bringing greater oversight to these emerging sectors, citing concerns around investor protection, market manipulation, and systemic risks.

Furthermore, Gensler has been a strong proponent of environmental, social, and governance (ESG) issues, recognizing the increasing importance of sustainable investing practices in today’s financial landscape. Under his leadership, the SEC has taken steps to enhance disclosure requirements related to climate-related risks and to promote greater accountability among corporate entities in addressing ESG considerations.

However, Gensler’s regulatory approach has not been without controversy. Some critics have raised concerns about the potential for overregulation stifling innovation and impeding market efficiency. In particular, Gensler’s push for stricter enforcement measures, such as increased scrutiny of special purpose acquisition companies (SPACs) and private equity funds, has drawn criticism from certain segments of the financial industry.

As Gensler prepares to hand over the reins to his successor, speculation abounds regarding who will fill his shoes and what direction the SEC will take under new leadership. With the upcoming change in administration, there is anticipation that President Trump will nominate a replacement who aligns with his administration’s deregulatory agenda. This shift in leadership could have far-reaching implications for the financial markets and the regulatory landscape, as the SEC continues to grapple with evolving challenges and emerging risks.

In conclusion, Gary Gensler’s impending departure as SEC Chair marks the end of a transformative era characterized by a renewed focus on regulatory reform and investor protection. While his tenure has been marked by notable achievements and significant regulatory advancements, it has also stirred debate and contention regarding the appropriate balance between regulation and market innovation. As the SEC prepares for a new chapter under fresh leadership, the financial industry awaits with bated breath to see what changes lie ahead and how they will shape the future of securities regulation in the United States.