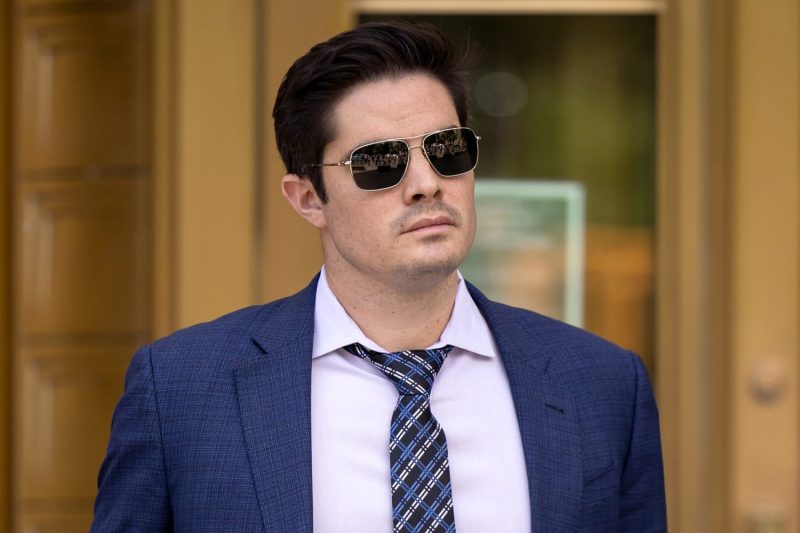

The recent sentencing of an FTX executive to 7.5 years in prison has sent shockwaves through the cryptocurrency industry, shedding light on the complex dynamics and consequences of betrayals within the high-stakes world of digital finance.

The case, involving an executive turning against Sam Bankman-Fried, the prominent figure behind FTX exchange, illustrates the real-world implications of internal strife and unethical actions in the realm of cryptocurrency trading. As the FTX platform gained popularity and trust among traders, the betrayal from within the company serves as a cautionary tale about the risks and repercussions associated with breaching trust and engaging in deceptive behavior.

The executive’s decision to turn on Bankman-Fried, a widely respected figure in the cryptocurrency community, reflects the intricate power dynamics and personal motivations that can influence behavior within corporate environments. The fallout from this internal conflict underscores the importance of transparency, integrity, and accountability in the rapidly evolving landscape of digital assets.

Moreover, the legal implications of the executive’s actions highlight the need for strict adherence to regulations and ethical standards in the cryptocurrency space. As governments and regulatory bodies worldwide grapple with how to effectively govern digital currencies, cases like this serve as a stark reminder of the potential consequences of non-compliance and illicit activity.

The sentencing of the FTX executive to 7.5 years in prison serves as a somber reminder of the serious nature of betrayals and misconduct in the cryptocurrency industry. While the allure of quick profits and the fast-paced nature of digital finance can be enticing, ethical lapses and breaches of trust can have far-reaching consequences for individuals, companies, and the industry as a whole.

As stakeholders in the cryptocurrency space reflect on this high-profile case, it is imperative to prioritize honesty, integrity, and accountability in all dealings. By upholding ethical standards and fostering a culture of trust and transparency, the industry can continue to mature and thrive in a sustainable and responsible manner.

In conclusion, the sentencing of the FTX executive underscores the need for vigilance, integrity, and adherence to regulations in the cryptocurrency industry. This case serves as a stark reminder that ethical lapses and betrayals can have severe consequences, both for individuals and the broader ecosystem. Moving forward, it is essential for all stakeholders to prioritize ethical behavior and responsible business practices to ensure the long-term viability and credibility of digital finance.