Sector Rotation Model Flashes Warning Signals

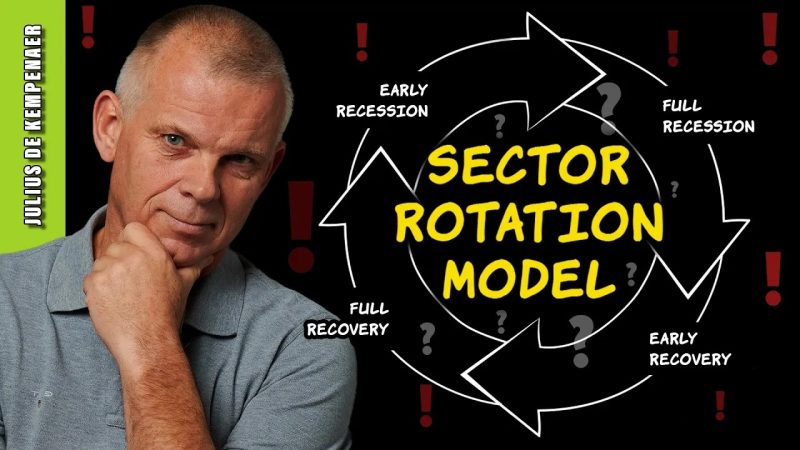

As the global economy continues to navigate through a volatile period marked by economic uncertainty and shifting market dynamics, investors are keenly observing various indicators to gauge potential market risks and opportunities. Of particular interest is the sector rotation model, a key tool used by investors and analysts to assess the relative performance of different sectors within the market.

The sector rotation model utilizes historical data and market trends to identify periods when specific sectors are likely to outperform or underperform the broader market. By analyzing these rotations, investors can strategically allocate their resources to sectors that are expected to show strength while avoiding sectors that may face challenges.

Recently, the sector rotation model has been flashing warning signals, indicating potential headwinds for certain sectors in the near term. One key indicator that is contributing to this caution is the shifting sentiment towards growth stocks versus value stocks. Historically, growth stocks have outperformed during periods of economic expansion, while value stocks have shown resilience during market downturns. However, current market conditions suggest a reversal of this trend, with value stocks gaining favor over growth stocks.

Another factor contributing to the warning signals from the sector rotation model is the changing dynamics within the technology sector. Technology stocks have long been a driver of market performance, with leading companies consistently outperforming the broader market. However, concerns around regulatory scrutiny, valuation levels, and potential saturation in certain tech sub-sectors have raised questions about the sustainability of the tech sector’s dominance.

Additionally, the energy sector has emerged as a focal point for investors, with fluctuating oil prices and geopolitical risks adding volatility to the sector. As countries navigate the transition towards renewable energy sources and climate-conscious policies, traditional energy companies face challenges in adapting to these changing market dynamics. This uncertainty has led to caution among investors, with the sector rotation model highlighting potential risks within the energy sector.

In conclusion, while the sector rotation model serves as a valuable tool for investors to navigate market rotations and identify opportunities, the current warning signals flashing within certain sectors underscore the importance of a cautious and strategic approach to investment decisions. By staying informed, analyzing market trends, and diversifying portfolios, investors can position themselves to weather potential challenges and capitalize on emerging opportunities in the evolving market landscape.