In recent times, the debate over the impact of rate cuts on stock performance has been a topic of heated discussion among investors and financial analysts. Rate cuts by central banks are often viewed as a tool to stimulate economic growth by reducing borrowing costs for businesses and consumers. However, the relationship between rate cuts and stock performance is not as straightforward as many may believe.

One prevailing argument in favor of rate cuts spurring stock market growth is the notion that lower interest rates make borrowing cheaper, encouraging businesses to invest in expansion and innovation. This increased business activity can lead to higher corporate earnings, which in turn can boost stock prices. Additionally, lower interest rates can make equities more attractive compared to fixed-income investments, leading to more capital flowing into the stock market.

On the other hand, some experts caution that the positive impact of rate cuts on stock performance may be limited. They argue that in certain economic conditions, such as a prolonged period of low growth or high uncertainty, rate cuts may not be sufficient to drive significant stock market gains. In such cases, other factors such as company earnings, global economic trends, and geopolitical events may have a more substantial influence on stock prices than changes in interest rates.

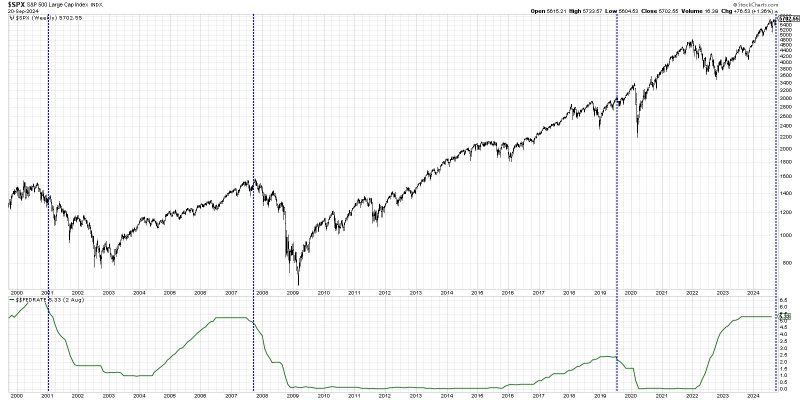

Another important consideration is the timing of rate cuts and their perceived effectiveness. Central banks may implement rate cuts in response to economic indicators signaling a potential slowdown or recession. In these situations, stock market investors may interpret rate cuts as a signal of underlying economic weakness, leading to market volatility and declining stock prices despite the lower borrowing costs.

Moreover, the impact of rate cuts on different sectors of the stock market can vary significantly. For example, rate cuts may benefit interest-rate sensitive sectors like real estate and utilities, as lower borrowing costs can boost demand for these investments. Conversely, sectors that rely heavily on economic growth, such as technology and consumer discretionary, may not experience the same level of positive impact from rate cuts.

In conclusion, the relationship between rate cuts and stock performance is multifaceted and influenced by a variety of factors beyond just changes in interest rates. While rate cuts may provide a temporary boost to stock prices in certain circumstances, their long-term impact on the stock market is nuanced and contingent on broader economic conditions. Investors should consider a holistic view of market dynamics and company fundamentals when evaluating the potential effects of rate cuts on their investment portfolios.