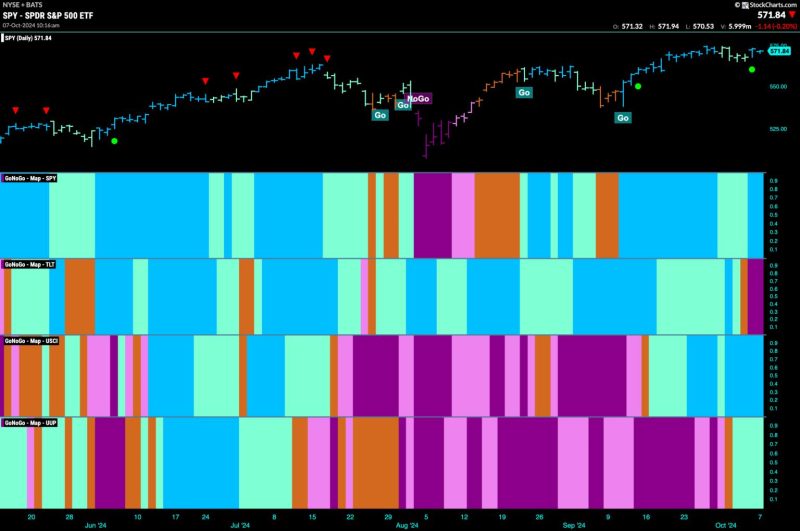

Equities Remain in Go Trend and Lean into Energy

Equities in a ‘Go Trend’

Equities have continued to demonstrate strength as they remain in a ‘Go Trend’. When it comes to trend following, the ‘Go Trend’ methodology emphasizes buying equities that are demonstrating strength or are in an upward trend. Investors are encouraged to ride these trends until they show signs of weakening, enabling them to potentially capture significant gains along the way. By staying in sync with such trends, investors may be able to maximize their profits and minimize downside risks.

Moreover, by following the ‘Go Trend’, investors can potentially benefit from the phenomenon known as momentum, where assets that have recently performed well are more likely to continue to perform well in the near future. This trend-following approach is often favored by traders and investors seeking to capitalize on short to medium-term price movements in the market.

Lean into Energy Sector

One sector that has shown promising strength and momentum recently is the energy sector. Energy stocks have been on an upward trajectory, driven by various factors such as rising oil prices, increased demand for energy commodities, and positive sentiment towards the industry as a whole. Investors who have leaned into the energy sector have likely seen their investments perform well in line with the ‘Go Trend’ strategy.

In addition, the energy sector offers diversification benefits to investors looking to hedge against volatility or downturns in other sectors. By including energy stocks in their portfolios, investors can potentially reduce overall portfolio risk and enhance returns over the long term.

Key Considerations for Investors

While riding the ‘Go Trend’ and leaning into the energy sector can offer attractive opportunities, it is essential for investors to exercise caution and conduct thorough research before making investment decisions. Here are some key considerations to keep in mind:

1. Risk Management: It is crucial for investors to manage their risk exposure effectively, especially when following trend-following strategies. Setting stop-loss orders and diversifying across different sectors can help mitigate potential losses.

2. Fundamental Analysis: Despite following trends, investors should not overlook the importance of fundamental analysis. Understanding the underlying value drivers of individual stocks within the energy sector can provide valuable insights for making informed investment decisions.

3. Market Volatility: Investors should be prepared for market volatility, which can impact the performance of equities in the energy sector. Staying informed about macroeconomic factors, geopolitical events, and industry-specific developments is key to navigating market volatility effectively.

4. Long-Term Perspective: While trend following can be profitable in the short term, investors should also maintain a long-term perspective when building their investment portfolios. Diversification, asset allocation, and consistency are key principles for achieving sustainable long-term growth.

In conclusion, equities remain in a ‘Go Trend’, presenting opportunities for investors to capitalize on rising trends in the market. By leaning into sectors such as energy and following a disciplined approach to trend following, investors can potentially enhance their investment returns and achieve their financial goals over time.