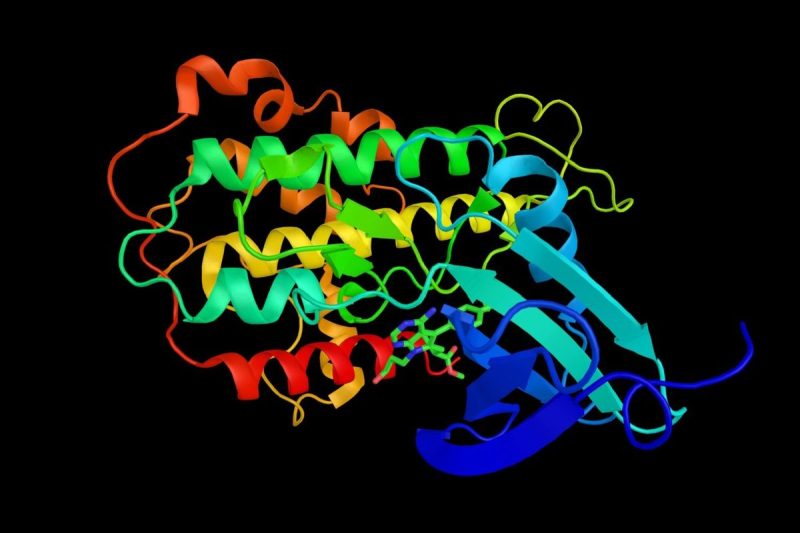

AlphaFold is a cutting-edge technology developed by DeepMind Technologies, a subsidiary of Alphabet Inc. This advanced AI system is designed to predict how proteins fold, a task that has eluded scientists for decades. The potential applications of AlphaFold are vast, spanning drug discovery, disease treatment, and even environmental sustainability.

Investing in AlphaFold stock presents a unique opportunity for investors looking to capitalize on the future of healthcare and biotechnology. Here are some key considerations for those interested in investing in AlphaFold stock:

1. Understanding the Technology:

One of the first steps in investing in AlphaFold stock is to ensure a basic understanding of the technology behind the product. AlphaFold uses deep learning algorithms to predict protein folding with unprecedented accuracy. This breakthrough has the potential to revolutionize the field of structural biology and unlock new possibilities in drug development and personalized medicine.

2. Assessing the Market Potential:

Before investing in AlphaFold stock, it is essential to evaluate the market potential for the technology. The protein folding market is estimated to be worth billions of dollars, with significant demand from pharmaceutical companies, biotech firms, and academic research institutions. As AlphaFold continues to demonstrate its capabilities, the market for its services is expected to grow exponentially.

3. Analyzing the Competition:

Another important factor to consider when investing in AlphaFold stock is the competitive landscape. While AlphaFold currently leads the industry in protein folding prediction, other companies are also investing heavily in AI-driven solutions for drug discovery and structural biology. Investors should assess the strengths and weaknesses of competing technologies to gauge AlphaFold’s long-term competitive advantage.

4. Long-Term Prospects:

Investing in AlphaFold stock requires a long-term perspective, given the complexity of the technology and the evolving nature of the market. While AlphaFold has already made significant strides in the field of protein folding prediction, the full impact of its technology is yet to be realized. Investors should consider the company’s research pipeline, partnerships, and strategic initiatives to evaluate its long-term growth potential.

5. Risk Management:

As with any investment, there are risks associated with investing in AlphaFold stock. While the technology shows immense promise, there are regulatory uncertainties, intellectual property concerns, and operational risks that could impact the company’s financial performance. Investors should diversify their portfolios and conduct thorough due diligence before committing to AlphaFold stock.

In conclusion, investing in AlphaFold stock offers a unique opportunity to participate in the future of healthcare and biotechnology. By understanding the technology, assessing the market potential, analyzing the competition, evaluating long-term prospects, and managing risks, investors can make informed decisions about investing in AlphaFold stock. With its groundbreaking AI technology and transformative applications, AlphaFold has the potential to be a game-changer in the field of protein folding prediction.