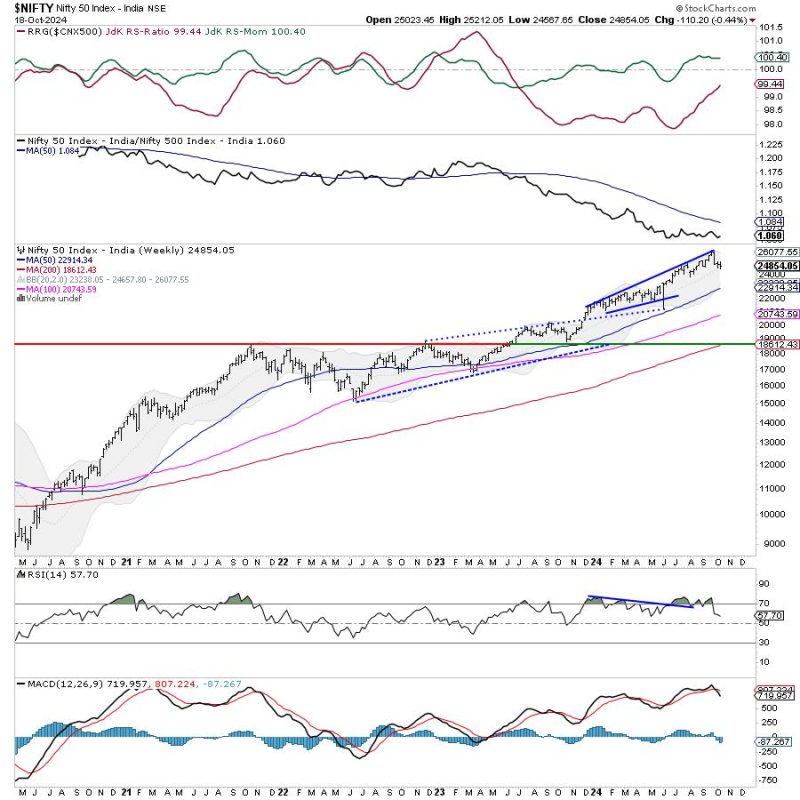

The week ahead for the Nifty 50 index may witness a period of consolidation, as the market may continue to trade within a specific range. However, significant trending moves are anticipated only if certain key levels are breached.

Technical analysis suggests that the Nifty 50 is likely to face resistance around the 15,900 levels. This level has acted as a strong barrier in the past, preventing the index from breaking out significantly higher. On the downside, support is seen around the 15,500 mark, which has been a crucial level for the Nifty in the recent past.

For the Nifty to witness a sustained uptrend, it would need to decisively breach the resistance at 15,900 and sustain above it. This would signal a bullish momentum in the market and could potentially lead to further upside movement.

On the flip side, a break below the support at 15,500 could indicate a shift in sentiment towards bearishness. If the index convincingly falls below this level, it may open the doors for a deeper correction and test lower support levels.

Market participants are advised to closely monitor these key levels and pay attention to any significant breaches. Monitoring key technical indicators, such as moving averages and trend lines, can also provide valuable insights into the market direction.

Furthermore, external factors such as global market trends, economic data releases, and geopolitical events should be taken into consideration while formulating trading strategies for the week ahead.

In conclusion, while the Nifty 50 index may experience a period of range-bound trading in the upcoming week, traders and investors need to remain vigilant and be prepared for potential trending moves that could occur if critical support and resistance levels are breached. Staying informed and adapting to changing market conditions will be essential for navigating the dynamic landscape of the stock market.