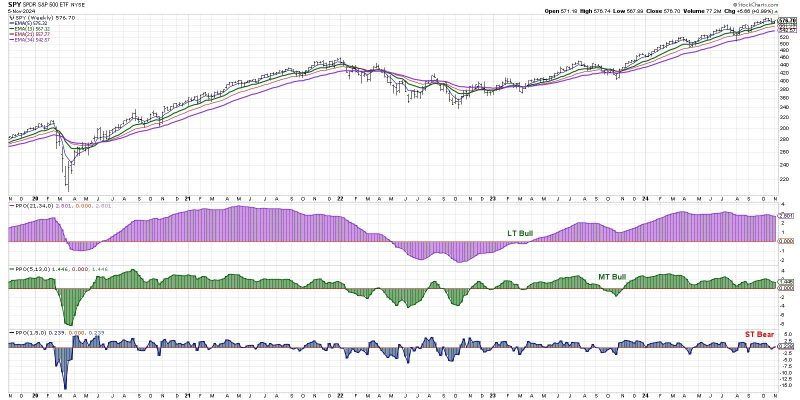

The recent market activity has sparked speculations of a short-term bearish signal as investors brace themselves for a week packed with significant news events. From economic data releases to central bank meetings, market participants are preparing to navigate potential volatility and make informed decisions in the face of uncertainty.

One of the key factors contributing to the current bearish sentiment is the looming Federal Reserve meeting. With investors closely monitoring the Fed’s decision on interest rates and its stance on monetary policy, any unexpected announcements could trigger market reactions. The uncertainty surrounding the Fed’s next steps has added to the cautious approach adopted by traders, driving selling pressure in the market.

Furthermore, the release of crucial economic indicators, such as employment data and inflation numbers, will provide insights into the health of the economy and potentially influence market sentiment. A weaker-than-expected data could further exacerbate the bearish outlook and prompt investors to reevaluate their positions.

Geopolitical tensions and global events also weigh heavily on market dynamics, as any unexpected development could quickly shift the market sentiment. From trade tensions to political uncertainties, external factors continue to present challenges for investors navigating the turbulent marketplace.

In response to the anticipated news-heavy week, investors are adopting risk-management strategies to mitigate potential losses and protect their portfolios. Diversification, hedging, and setting appropriate stop-loss levels are some of the techniques being employed to safeguard investments in the face of market volatility.

While the short-term bearish signal looms over the market, investors are advised to remain vigilant, stay informed, and consider the potential impact of upcoming events on their investment decisions. By staying attuned to market developments and exercising caution in their trading strategies, investors can navigate the current market environment and position themselves for success in the long run.